Last Week in ConTech - 15 September 2025

Data Centers Are Propping Up U.S. Construction

Deep insight: Data Centers Are Propping Up U.S. Construction

This week, the United States Census Bureau reported that commercial construction contracted by nearly 1% in July and by 8.2% since July 2024.

Private nonresidential activity also fell 0.5% in July, with the Associated Builders and Contractors (ABC) chief economist calling the decline particularly concerning. One in four ABC members reported project delays or cancellations that month due to tariffs.

It’s concerning for the industry but on the other side, forward-looking indicators are telling a different story.

The Dodge Momentum Index, which tracks nonresidential projects entering the planning stages and leads actual construction spending by a full year, jumped 7.5% in August. It was led by an 8.7% rise in commercial planning and a 5.4% increase in institutional projects. August saw 51 new projects valued at over $100 million enter planning.

At the centre of this activity divergence is the promise of AI infrastructure.

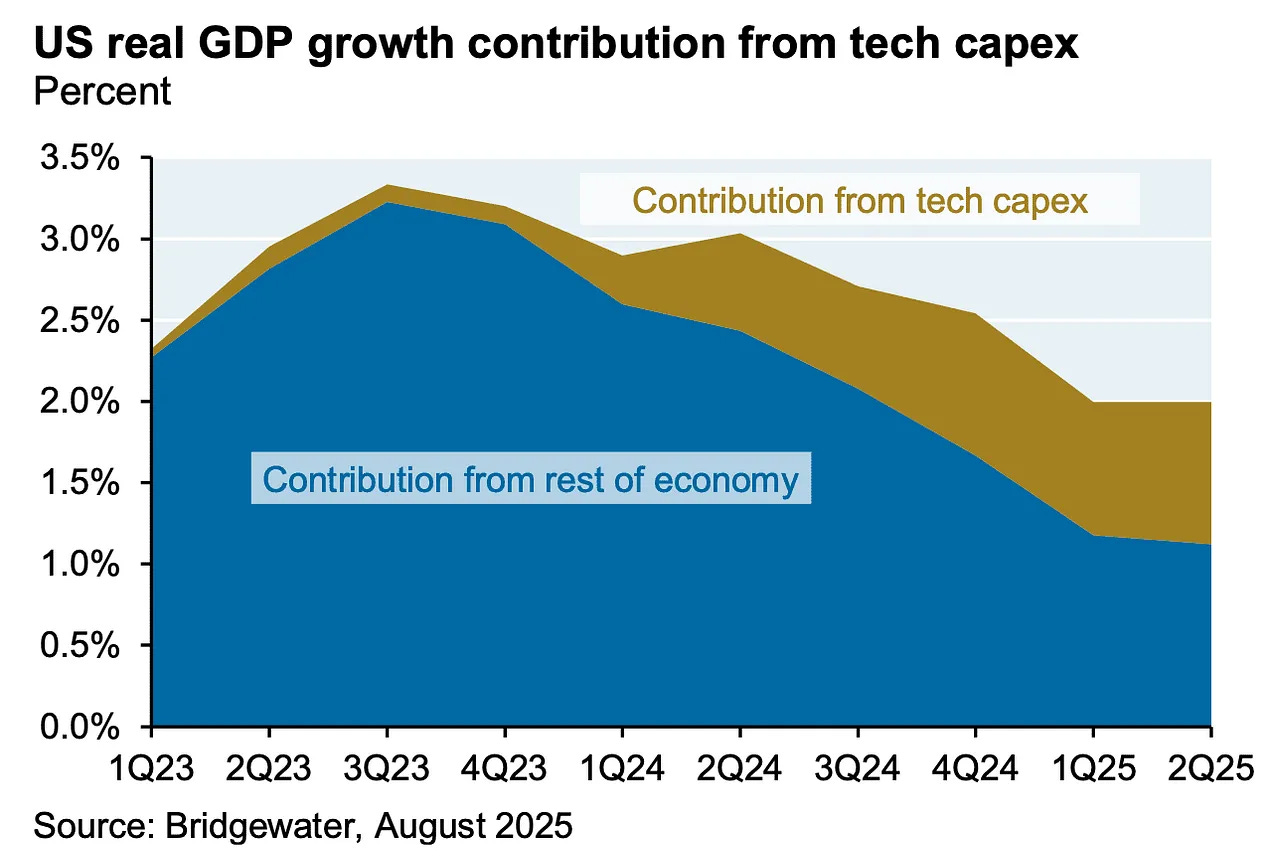

New analysis highlights the growing importance of AI capex with investments accounting for nearly half of the U.S. GDP growth.

Construction spending on data centers has hit an all-time high of $40 billion, up 30% from last year. Data center spend is now on track to surpass total office construction, a gap that was almost $60 billion just three years ago.

The numbers represent a seismic shift in the construction environment as project backlogs are impacted by tariffs, material price increases and interest rates. Pivoting to data centers is increasingly becoming a core strategy consideration. The question is if this change is cyclical or structural, but in the short term this seems like a boom no one wants to miss.

In this issue there are:

12 Startup Fundings

1 Startup Emerged from Stealth

10 Policy and Regulatory Changes

9 New National Infrastructure Projects & Priorities

0 New investment funds

0 Acquisitions

6 News articles

66 new jobs posted - view here

Reading time: 12 min

Startup Funding

Procurement

Fitting, a Saudi Arabian startup, raised $500k in pre-seed funding. They are developing a procurement platform which connects wholesales building material suppliers with retailers and real estate developers providing services such as tracking and order scheduling as well as assisting with language translation challenges. More here.

Kojo, a San Francisco startup, raised $10m in Series C extension funding. They have developed a procurement platform which streamlines the process of material ordering as well as tool management, allowing users to order from their phone with instant transparency and they offer fully digitized workflows for prefab shops. More here.

Autonomous Equipment

Flywheel AI, a Singapore-based startup, raised Pre-Seed funding (undisclosed). They have developed a solution which retrofits excavators for remote teleoperation and collects the datasets needed to automate the machines over the long term.

Agentic AI

Candid Intelligence, a San Francisco startup, raised $5.5m in Seed funding. They are developing AI agents for engineering, procurement, and construction projects focusing initially on the pre-construction phase for large infrastructure projects like data centres or process plants where it takes ~2 years of planning (bidding, engineering, procurement) before construction begins. More here.

Notes:

Agentic AI solutions are still very early in construction, which makes it interesting to review AI startups press releases and websites. These often reveal what features are currently resonating with the market.

For example, Candid highlights several AI privacy features:

On-premise deployment

All models and data stay within the organization’s infrastructure, with no cloud dependencies. This ensures maximum control and compliance.Role-based access control

Only authorized personnel can access project data, with engineers limited to information relevant to their role.Auditable AI actions

Every AI-driven workflow is fully traceable, including logs of what data was used, how, and by whom. This ensures accountability.

These features highlight what enterprise teams require when deploying AI solutions.

It’s because, in contrast to consumer applications, enterprise adoption requires strong governance and this shows what could be necessary to meet internal compliance requirements.

Expense Management

Speedchain, an Atlanta startup, raised $111m in equity and debt funding. They are developing commercial card programs and expense management solutions for the construction and project based economy allowing users to easily assign cost codes and types to support real time job cost tracking. More here.

Green Materials

X-Hemp, an Australian startup, raised $3.4m in Seed funding. They process industrial hemp into ‘hempcrete,’ a non-compustible, termite-proof and mould-resistance material which can be used as a low carbon alternative to concrete with a price point comparable to double brick. More here.

Asset Management

TDRI, a New Zealand startup, received funding (undisclosed). They have developed a trailer-mounted moisture sensing system leveraging Time Domain Reflectometry Imaging (TDRi) which rapidly scans for subsurface moisture beneath road paving which creates maps showing where water could erode, crack, and otherwise impair highways and byways for preventative maintenance. More here.

Tech-enabled Contractors

Flipspaces, a Mumbai startup, raised $50m in Series C funding. They have developed a technology enabled design and build solution for commercial interiors which uses virtual reality to provide a photo realistic interior design experience for the consumer and connects to their contracting arm consisting of an integrated supply chain network with curated vendors (200k+ products) to support end to end delivery. More here.

Notes:

The company announced they raised $35m in funding in May.

That was the first tranche of their Series C round.

Solenery, a Toronto startup, raised CAD $750k in Seed funding. They are developing a clean energy platform to increase the adoption of renewable solutions for residential and commercial building owners. More here.

Notes:

Solonery captures the top of funnel interest for renewable energy adoption.

A homeowner can enter their post code to receive insights on energy savings and available rebates.

They then can receive detailed analysis including cost projections and personalized feasibility studies.

This is passed on to vetted providers to offer quotes.

Additional note:

This approach for residential energy efficiency upgrades is really interesting to me.

Home services contractors often are poor at online marketing.

Solonery is able to outcompete them and offer a superior experience for prospective customers via an automated digital solution (e.g a homeowner enters their post code to see rebate options).

They then pass the lead on to the contractor for a referral fee.

As they scale they will be able to offer pricing power with fixed price contracts or be able to secure long term, dedicated labor supply via preferred partnerships or acquiring contractors.

Construction Management

Wehouse, an Indian startup, raised ~$2.8m in Series A funding. They have developed a platform to streamline the home building process connecting all stakeholders as well as providing real time monitoring and project management services so clients can track project progress digitally. More here.

Other

Dig Energy, a New Hampshire startup, raised $5m in Seed funding from investors including Suffolk Technologies. They have developed a water-jet drilling rig (instead of traditional cutting bits) which is being used to deliver cheap geothermal heating and cooling. More here.

Notes:

Heating and cooling represent about a third of all energy use in the U.S.

Geothermal offers a solution but adoption has been low due to the high cost.

There are two main types of geothermal:

Enhanced geothermal down to the tens of thousands of feet to tap very hot temperatures (e.g Fervo).

Shallow geothermal, which Dig is focused on, goes down to the hundreds of feet.

At shallow geothermal depths, the ground maintains a consistent temperature which is perfect for heating and cooling residential and commercial buildings.

In this type, pipes carry water underground where it transfers heat to or from the earth.

In the summer, it dumps excess heat, and the chilled water returns to the surface to cool a building.

In the winter, it absorbs heat to warm it.

Ayr Energy, a Texas startup, raised Seed funding. They design and manufacture grid equipment. More here.

Notes:

The US has ~60m transformers installed across the country.

At least half of these are approaching end of life and require replacement.

At the same time, due to electrification, AI and reindustrialisation, we require an additional ~120m transformers.

This demand has resulted in supply chain delays with lead times averaging 2+ years.

Out of Stealth

Ideatura, a UK startup, emerged out of stealth. They are developing a chat based natural language tool for interacting with Revit. It allows teams to automate dimensions, tags, views and sheets as well as 3D modelling using commands and offers features such as smart drawing review and a compliance and regulation checker. View the website here.

Policy and Regulatory Changes

US

Trump EPA seeks to speed up permitting for AI infrastructure

The EPA proposal will redefine the pre-construction requirements for power plants, manufacturing facilities and other infrastructure.

It would enable companies to start some construction that is not related to air emissions prior to obtaining Clean Air Act construction permits.

US immigration agents arrest hundreds at Hyundai plant, mostly Koreans

Hundreds of workers at a Hyundai Motors car battery facility under construction in Georgia, were detained in a raid by U.S. authorities.

About 475 workers, most of whom were South Korean nationals, were arrested.

Notes:

The raid has delayed construction by at least 2 to 3 months as the company faces challenges in filling positions.

Trump’s new EV move has gas stations pumped

The unfreezing of the $5 billion National Electric Vehicle Infrastructure program to build charging stations along highways came with a new recommendation.

The Federal Highway Administration asks states to use the money to support “charging locations where the charging station operator is also the site host (i.e., property owner).”

This favors gas stations and truck stops as they own or lease the land.

Charging providers like Tesla and Electrify America, who are specialists at building and operating stations, rarely own the land (e.g. shopping centre parking lots).

DOL moves to repeal independent contractor rule

The Department of Labor intends to rescind a 2024 rule on independent contractor classification.

The rule is a method of determining if a worker is an independent contractor or a full-time employee, and therefore owed benefits by their employer.

For construction, the rule is significant in determining if someone is employed as a subcontractor or directly by the general contractor on the jobsite.

House joins Senate to fund low-income HVAC program

A Congressional committee has moved to fund a federal program that helps low-income families repair or replace their HVAC equipment.

This is despite the Trump administration’s plans to slash it.

They approved a 2026 budget that includes nearly $4.04 billion for the ‘Low Income Home Energy Assistance Program’ (LIHEAP).

Massachusetts Wants to Ease Environmental Rules to Boost Housing

The Massachusetts Governor is proposing to reduce the environmental review period to 30 days for many planned apartment and condominium buildings.

The current review process can take a year or more.

With an executive order, Maryland aims to build more houses faster

The Maryland Governor signed an executive order aimed at increasing housing development in the state.

The Housing Starts Here order tasks state agencies with identifying state-owned properties for transit-oriented development and reducing permitting timelines.

It also establishes housing production targets for localities with planning and zoning authority and a state housing ombudsman to ensure developments are not delayed.

India

Incentive scheme in the works: Construction gear production likely to get ₹16,000 crore buildup

Inter-ministerial consultations have begun for a ₹14,000-16,000 crore ($~1.5-1.8b) incentive scheme for the construction equipment manufacturing industry.

Proposals for supporting the indigenisation of construction equipment, tunnel boring machines and cranes have been initiated.

UK

Hedgehog highways could become requirement for new buildings

A cross-bench group of peers has tabled amendments to the government’s planning bill to ensure new buildings must have wild animal-friendly design and architecture including hedgehog highways and bird nesting boxes.

Notes:

Hedgehog highways are small openings cut at ground level in fences or walls so hedgehogs can move freely between gardens and green spaces to find food and mates.

South Korea

Gov’t to support construction of 1.35 mil. new homes by 2030

The government will supply 1.35 million new homes by 2030 under a new housing plan.

This is equivalent to adding 270,000 new homes in Seoul, Incheon and Gyeonggi Province per year, and a net gain of 110,000 new homes compared to the average from 2022 to 2024.

Since 2019, the capital region has seen housing shortages while the rest of the country sees extreme oversupply.

National Infrastructure Projects & Priorities

Global

Global solar installations rise 64%, to 380 GW, in first half of 2025

Worldwide, 380 GW of new solar capacity was installed in the first half of this year, marking a 64% increase from 2024.

China led the pack in solar installations, adding 256 GW, more than twice as much solar capacity as the rest of the world combined.

India came in second behind China, installing 24 GW, while the U.S. installed 21 GW.

Clean hydrogen faces challenges globally amid U.S. pullback

A new joint report finds that "committed" investment in "clean hydrogen" now exceeds $110 billion across 510 projects.

They tally 6 million metric tons annually of production capacity in these projects, of which 1 million is up and running.

US

Nebius Soars 53% as Microsoft Deal Validates Russian Breakup

Nebius Group NV shares soared after signing an artificial intelligence infrastructure deal with Microsoft Corp.

The deal is worth at least $17.4 billion through 2031, with options that could increase the value by as much as $2 billion.

Nebius will provide Microsoft with dedicated artificial intelligence computing capacity from a new data center in Vineland, New Jersey, beginning later this year.

Europe

Goldman Sees Europe Power-Supply Risks as Demand Growth Returns

Europe is set to see power demand rise after 15 years of decline.

The region's electricity demand will grow annually from 2026, pushing reserve margins close to zero by 2029

A reserve margin below 10% to 15% is considered the danger zone for blackouts.

Europe may need as much as €3 trillion of investment over the next decade to avoid power cuts.

Norway

Norway’s $2 Trillion Fund Looks to Expand Renewables Investments

Norway’s $2 trillion sovereign wealth fund is looking to expand its renewables investments.

The fund has allocated $8 billion out of $38 billion earmarked for renewable energy infrastructure and has 10 investments in five countries.

It will expand into other technologies and geographies beyond Europe and is looking for new strategic partners.

Africa

Disasters Ruin $12.7 Billion of Africa Infrastructure Yearly

The average annual loss of infrastructure including buildings caused by disasters in Africa is $12.7 billion.

70% of the damage is caused by floods.

Earthquakes, which are less frequent but more catastrophic, cause ~28% of damage.

Ethiopia

Ethiopia Inaugurates Africa’s Biggest Dam Amid Egypt Row

Ethiopia inaugurated Africa’s biggest hydroelectric dam, which could power homes and industries across East Africa.

The dam's operation has deepened a dispute with Egypt and Sudan over the flow of the Nile, the main source of fresh water for more than 100 million people.

The downstream nations are seeking a binding agreement on managing the Nile.

The ~$4.8b project took 14 years to complete.

Turkey

AIIB and TKYB Sign USD200-million Facility to Support Climate and Digital Transition in Türkiye

The Asian Infrastructure Investment Bank (AIIB) and the Development and Investment Bank of Türkiye (TKYB) have signed a USD200-million equivalent lending facility.

This will support private-sector sub-projects in climate mitigation, climate adaptation and digital infrastructure.

It includes renewable energy such as wind and solar, energy efficiency, battery energy storage systems, and decarbonization in energy-intensive industries.

New Zealand

New Zealand Sovereign Fund Touts More Infrastructure Investment

The New Zealand Superannuation Fund, one of the world’s best-performing sovereign wealth funds, is looking for opportunities to invest in domestic infrastructure such as roads.

They are seeking to invest in large-scale infrastructure opportunities in New Zealand where they can sit alongside international or domestic capital that has operating sector experience.

They have NZ$85.1 billion ($50 billion) funds under management.

Notes:

They noted that there is a stated need for roads in New Zealand.

News

Beyond the Blueprint: Firmus’ Vertical AI Journey from Seed to Bluebeam (Navitas Capital)

Construction Industry Veterans Form ‘Built by Builders’ Network to Drive Technology Adoption

This is an initiative of construction technology companies founded by individuals with substantial experience in architecture, engineering, or construction.

The network emerged from customer feedback indicating greater trust in solutions built by people who have experienced the same challenges firsthand.

It includes eight companies addressing different construction pain points.

Trump Tried to Kill the Infrastructure Law. Now He’s Getting Credit for Its Projects.

'AI can’t install an HVAC system': Why Gen Z is flocking to jobs in the trades

Enrollment at trade schools is expected to grow 6.6% a year for programs like HVAC and welding.

Geopolitical Risk Prompts Rush Into Infrastructure, IFM Says

Heightened geopolitical risk and macroeconomic volatility are driving fund managers to infrastructure investments.

Allocations to infrastructure will grow, with the proportion of investors allocating to infrastructure due to increase globally to 60% from 49% by 2030.

China’s Concrete Empire in South America

If I missed anything this week, please reply and let me know! I’ll make sure to include it next week.