This report is written by the Zacua Ventures team. They are an early-stage ventrue capital firm focused on investments in the Built Environment at a global scale.

Note: Zacua Ventures are hosting a meetup in Melbourne, Australia next week. Sign up here.

Why this report?

We are in the phase of human evolution where our needs and aspirations are growing at an unprecedented pace. We face a scenario where the infrastructure is struggling to keep pace with our expectations for improving quality of life. This extends from basic expectations like housing, power and water to new age expectations like transportation and communication. Our industry plays a pivotal role in shaping the growth and maintenance of infrastructure and this feels like an opportune time to understand the adoption of Contech in this sector.

Contents

Defining Infrastructure in the Built Environment

The Evolving Role of Infrastructure

Market Overview and Growth Potential

Key Drivers of Growth

Critical Issues Facing the Infrastructure Sector

Key Segments that make up the Infrastructure Sector

Digital Infrastructure

Transport and Logistics Infrastructure

Energy Infrastructure

Utilities Infrastructure

Emerging Infrastructure Trends to Watch

Why Infrastructure Matters Now: Global Drivers

Unique Challenges for Technology in Infrastructure

Emerging Technologies Transforming Infrastructure

Corporate-Startup Engagement and the Pace of Adoption

Current vs Forward-Looking Pace of Adoption

Reading time: 40 mins

Does the email get cut off by your reading application? You can view the full version online here.

Defining Infrastructure in the Built Environment

In the built environment context, we define infrastructure to be foundational physical structures, systems, and services that enable cities and communities to function. This includes buildings and the construction processes that create them and the networks delivering energy, water, and mobility that are closely tied to those built assets. In practical terms, the built environment encompasses everything from the houses and offices we occupy to the distribution systems that provide electricity and water and the roads, bridges, and transit systems that connect them. Modern infrastructure also increasingly involves digital components (sensors, controls, data networks) embedded in physical assets, blurring the line between traditional bricks-and-mortar and smart technology systems. The scope of built environment infrastructure thus spans:

Vertical infrastructure (buildings and facilities): Residential, commercial, and industrial buildings, along with the sustainable materials and construction methods used to erect them.

Horizontal infrastructure (civil works): Transportation networks (roads, bridges, rail, ports), utilities (power grids, water and sewage pipelines), and public spaces that support and connect built structures.

Service delivery systems: Technology-enabled platforms for energy, water, and mobility services that interface with buildings – for example, the electric grid and on-site renewable energy for powering buildings, municipal water supply and emerging on-site water recycling systems in facilities, and transportation services (from EV charging stations to adjacent mobility hubs) integrated into developments.

This holistic definition underscores that built environment infrastructure is not just the isolated utilities or standalone buildings but an interconnected fabric of physical assets and service networks that provide people with living and working spaces and the essential services (power, water, transportation, data) to use those spaces effectively. It highlights why innovating in this domain requires systems thinking – improvements in one piece (like a smarter building management system) can ripple through energy and mobility networks and vice versa.

The Evolving Role of Infrastructure

Infrastructure has transcended its historical role as a passive enabler of economic activity. Today, it is a dynamic contributor to global progress, facilitating urbanization, enhancing quality of life, and accelerating technological advancements. With the global population projected to reach nearly 10 billion by 2050, the demand for sustainable, efficient, and resilient infrastructure has never been greater.

As urbanization intensifies, particularly in emerging markets, innovative infrastructure solutions are required to manage environmental, social, and economic pressures. The COVID-19 pandemic further highlighted the need for adaptive infrastructure, exposing vulnerabilities in supply chains, healthcare systems, and digital connectivity. Studies reveal a 25% average increase in civil and infrastructure backlogs since the pandemic. Governments, private investors, and multilateral organizations are now prioritizing infrastructure investments that foster resilience, reduce emissions, and close the global infrastructure funding gap, projected to exceed $15 trillion by 2040. This rapid increase in attention has consequently led to an increase both capital and technology deployment in the sector.

Market Overview and Growth Potential

The global infrastructure market, encompassing transportation, energy, utilities, and digital infrastructure, is poised for significant growth. As of 2023, the market was valued at approximately $9.9 trillion, with projections to surpass $15.83 trillion by 2030, growing at a compound annual growth rate (CAGR) of 6.84%.

Key Drivers of Growth

Urbanization and Population Growth: Rapid urbanization in Asia, Africa, and Latin America is fuelling demand for advanced infrastructure networks.

Technological Advancements: IoT, AI, and blockchain are revolutionizing infrastructure operations, enabling predictive maintenance and energy efficiency.

Decarbonization and Sustainability: The global renewable energy market is growing exponentially, with significant investments in solar, wind, and other green technologies. Spain, for example, has strengthened its climate change targets by committing to a 32% reduction in emissions by 2030 from 1990 levels.

Critical issues facing the infrastructure sector

Aging Assets: Increasing spending is required to maintain and modernize aging infrastructure.

Civil Backlogs: Since the COVID-19 pandemic, there has been a 25% increase in civil and infrastructure backlogs.

Safety Concerns: On-site worker safety remains a top priority due to increasing safety regulations, inspections, and investigations.

Labor Shortages: The industry faces a shortage of skilled labour, partly due to an aging workforce. In the U.S., 22% of construction workers are aged 55 or older and nearing retirement.

Supply Chain Disruptions: Material shortages have led to cost overruns and project delays, emphasizing the need for resilient procurement strategies.

Carbon Emissions: Nearly 40% of global CO2 emissions originate from the construction industry, highlighting the urgent need for sustainable practices.

Low Digitalization: Despite being the second-largest industry, the built ecosystem remains the second least digitized, with a significant proportion of contractors still using pen and paper for project management.

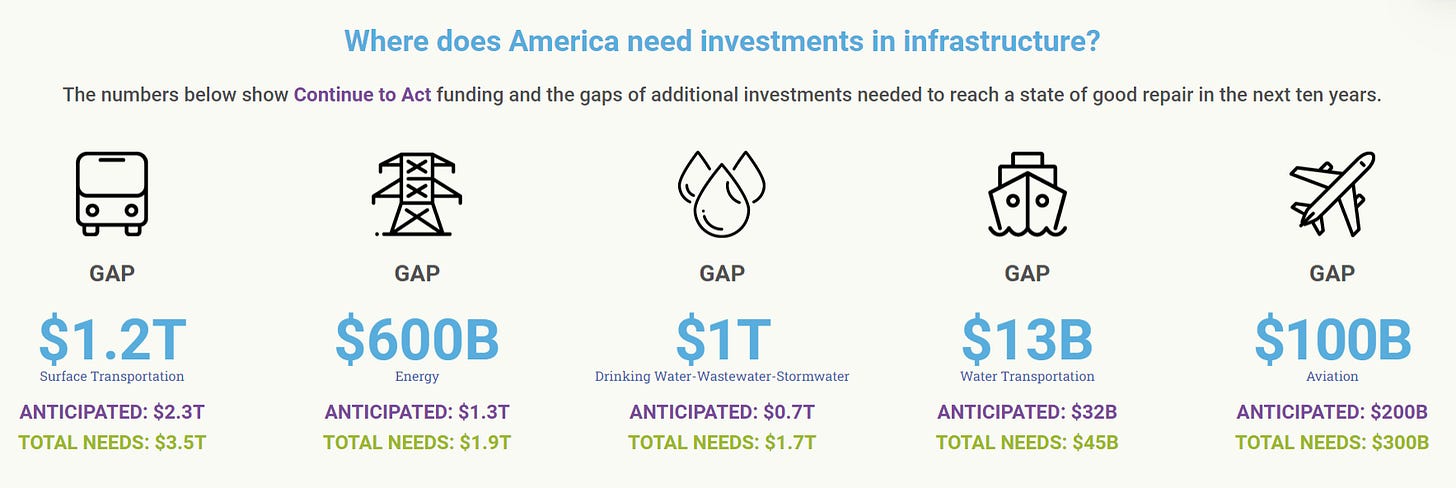

Funding Gap: Insufficient capital allocation continues to be a major challenge in meeting global infrastructure needs. The American Society of Civil Engineers (ASCE) estimates that nearly $7.4 trillion is needed across 11 infrastructure areas by 2033, including highways, bridges, rail, transit, and energy systems. Under current investment scenarios, funding gaps could range between $2.9 trillion and over $3.7 trillion, depending on policy and economic conditions.

Urban Congestion: Costs billions annually, with drivers in cities like Los Angeles spending 119 hours in traffic each year.

Transportation Emissions: In 2020, the transportation sector contributed approximately 20% of global greenhouse gas emissions, with over 40% originating from private cars.

Key segments that make up the infrastructure sector

Digital Infrastructure

Digital infrastructure encompasses the foundational resources, systems, and technologies that enable digital services and connectivity on a global scale. This infrastructure includes various components such as telecom networks, Datacenters, Fiber optic networks, cloud infrastructure, and wireless technologies like 5G and 6G. These elements collectively facilitate seamless connectivity, efficient data exchange, and robust access to online services, making them indispensable for businesses, governments, and consumers alike. Beyond mere connectivity, digital infrastructure is a fundamental enabler of economic growth, technological innovation, and societal transformation. It supports everything from basic internet access to advanced industrial operations and global communication networks, positioning it as a cornerstone of the modern economy.

The criticality of digital infrastructure has only intensified as more industries embrace digital transformation. It forms the foundation for the deployment of advanced technologies such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), and the realization of smart cities. As digital dependency increases, robust infrastructure is vital for sustaining economic activity, improving quality of life, and fostering innovation across sectors ranging from healthcare to finance.

Growth Drivers

Several key factors are propelling the growth of digital infrastructure:

Data Consumption and Connectivity Needs: The rapid increase in data consumption, driven by streaming services, remote work, and the proliferation of IoT devices, is putting pressure on existing digital infrastructure. To meet this growing demand, significant investments are being made in Fiber networks and Datacenters. The rise of alternative network providers (AltNets) in countries like the U.K. is also reshaping the telecom landscape, increasing competition and coverage.

Government Initiatives and Public-Private Partnerships: Governments across the globe are enacting policies and investing in digital infrastructure to support economic growth and digital inclusivity. Programs like the U.S. Broadband Equity, Access, and Deployment (BEAD), which allocates USD 42.45 billion to broadband projects, exemplify the role of public sector initiatives in driving infrastructure growth. These efforts are especially critical in bridging the digital divide and fostering connectivity in developing regions.

Data Sovereignty and Edge Computing: Increasingly stringent data sovereignty laws are creating a heightened need for localized Datacenters, as governments mandate that data be stored within national borders to ensure security and privacy. This has led to an expansion in hyperscale and edge Datacenters, particularly in Europe and the Asia-Pacific. These localized Datacenters help meet compliance needs and provide low-latency solutions for emerging technologies.

Cloud Adoption and Digital Transformation: The growing adoption of cloud services is a major growth driver, requiring robust digital infrastructure to support scalability, security, and data management. As digital transformation accelerates across industries—from healthcare to finance—the demand for Datacenters, Fiber networks, and advanced telecom infrastructure continues to expand.

5G Rollout and Future Network Upgrades: The deployment of 5G networks is reshaping industries by providing ultra-low latency and high-speed connectivity, crucial for IoT and smart city applications. As investments in future technologies like 6G emerge, they promise even more advanced capabilities, further driving the infrastructure market.

Transport and Logistics Infrastructure

Transport and logistics infrastructure forms the backbone of global trade, economic growth, and efficient mobility of goods and people. It includes diverse systems such as road networks, railways, air transport, maritime ports, logistics hubs, and multimodal facilities. These interconnected elements are crucial for seamless transportation and efficient supply chain operations, supporting industrial activities, trade expansion, and urban mobility. Beyond simply moving people and goods, transport and logistics infrastructure is a key enabler of economic development, global competitiveness, and societal connectivity. It forms the foundation for trade facilitation, urban growth, and industrial productivity, positioning it as a vital component of the modern economy.

The critical role of transport and logistics infrastructure has only intensified with the rise of e-commerce, urbanization, and evolving consumer expectations. This infrastructure supports not only long-haul movements but also last-mile deliveries, connecting rural regions to urban centers and global markets. With increasing demands on supply chain efficiency and mobility, investment in transport infrastructure is vital for sustaining economic growth, enhancing quality of life, and ensuring resilience against supply chain disruptions.

Market Overview

The global transport and logistics infrastructure market is set for substantial growth, driven by key trends such as increasing urbanization, the boom in e-commerce, and significant government spending on infrastructure projects. As of 2023, the transport and logistics infrastructure market was valued at approximately $6.8 trillion, with projections indicating that it could reach around $10.5 trillion by 2030, expanding at a compound annual growth rate (CAGR) of approximately 6.3%. This anticipated growth underscores the need for improved connectivity and efficiency in logistics networks to support growing economic activities.

Regionally, Asia-Pacific is emerging as the fastest-growing market, driven by rapid urbanization, rising middle-class income, and significant investments in infrastructure development. North America and Europe continue to lead in terms of established infrastructure quality and innovation, with a focus on sustainable and smart logistics solutions. Government initiatives like the Belt and Road Initiative in China and the infrastructure packages in the US further boost this spending.

Growth Drivers

Several key factors are propelling the growth of transport and logistics infrastructure.

Technological Advancements: The integration of technologies such as automation, smart traffic management, and digital twins in logistics is transforming transport infrastructure, making it more efficient and adaptable to modern needs.

Sustainability Focus: The push towards sustainable transport, including electrified rail, EV charging stations, and green shipping corridors, is driving innovation and investment in transport infrastructure.

Urbanization and Rising Consumer Demand: Increasing urban populations are creating greater demand for transport services, while rising consumer expectations, particularly in e-commerce, are driving the need for more efficient last-mile delivery networks.

E-commerce Boom: The rapid growth of e-commerce is placing increased pressure on logistics infrastructure, necessitating investments in warehousing, last-mile delivery, and multimodal facilities to manage growing parcel volumes and meet consumer expectations for faster delivery.

Government Initiatives and Public Spending: Governments across the globe are investing heavily in upgrading and expanding transport infrastructure to stimulate economic growth. Projects like the U.S. Infrastructure Investment and Jobs Act, which allocates $1.2 trillion for infrastructure improvements, are providing significant impetus to the sector.

Energy Infrastructure

Energy infrastructure represents the foundational systems and technologies that enable power generation, distribution, and storage on a global scale. This infrastructure forms the bedrock of economic development and societal function, encompassing everything from conventional power plants to advanced renewable systems. The transformation of energy infrastructure stands as perhaps the most critical challenge of our time, with estimates suggesting over $275 trillion in investment will be required by 2050 to support global net-zero transitions.

Beyond power provision, energy infrastructure serves as a fundamental enabler of industrial growth and technological innovation. Countries with advanced energy systems demonstrate 15-20% higher industrial productivity, highlighting the direct link between energy infrastructure sophistication and economic competitiveness. As industries worldwide embrace clean energy transition imperatives, the strategic importance of robust energy infrastructure continues to grow.

Market Overview

In 2023, the global energy infrastructure market was valued at $1,270 billion, and it is projected to grow to $1,906 billion by 2030, representing a CAGR of 7.19%. This growth is primarily driven by the rising global energy demand, rapid urbanization, and ambitious government initiatives aimed at achieving carbon neutrality. Investments in renewable energy sources such as solar, wind, and hydroelectric power are at the forefront, supported by advancements in energy storage technologies and smart grid innovations.

Regionally, Asia-Pacific leads the global energy infrastructure market, accounting for the largest share due to massive infrastructure projects in countries like China and India. These countries are heavily investing in renewable energy, grid upgrades, and electrification of rural areas to meet their growing energy needs. Meanwhile, Europe remains a pioneer in renewable energy adoption, with a strong focus on decarbonization, energy efficiency, and cross-border grid connectivity. In North America, efforts are concentrated on upgrading legacy infrastructure and integrating renewable energy with advanced storage systems to ensure grid stability and reliability.

The demand for energy infrastructure is further amplified by the adoption of smart technologies. Innovations such as smart grids, digital substations, and AI-driven energy management systems are helping optimize energy distribution and consumption, reducing wastage, and improving operational efficiency. Additionally, investments in grid-scale battery storage are critical for enabling the widespread adoption of intermittent renewable energy sources.

As the industry evolves, public-private partnerships (PPPs) are playing a vital role in financing energy infrastructure projects, particularly in emerging economies where funding gaps remain significant. The shift towards sustainable energy solutions has also unlocked new opportunities for venture capital and institutional investors, particularly in areas such as offshore wind farms, green hydrogen infrastructure, and electric vehicle (EV) charging networks.

Overall, the energy infrastructure market's outlook is robust, supported by the dual priorities of energy security and decarbonization. Investors and policymakers alike must focus on aligning infrastructure development with sustainability goals to ensure long-term economic and environmental benefits.

Growth Drivers

Several key factors are propelling the growth of digital infrastructure:

Technological Cost Reduction and Performance Improvements: The dramatic decline in renewable energy costs has revolutionized energy infrastructure economics, with solar PV and wind technology costs falling by over 85% and 56% respectively since 2010. Battery technology costs have similarly decreased by 89%. This cost revolution has achieved grid parity in 67% of global markets, fundamentally altering investment patterns and accelerating renewable energy deployment worldwide. The impact is particularly evident in utility-scale projects, which now routinely outcompete conventional power sources on cost.

Smart Grid and System Integration Advances: Advanced grid management systems have transformed energy infrastructure operations, delivering 45% improvement in transmission efficiency while reducing integration costs by 35%. These sophisticated systems enable real-time management of complex energy networks and facilitate unprecedented levels of renewable energy integration. The technology has proven particularly effective in markets like Denmark and California, where smart grid infrastructure manages high levels of renewable penetration while maintaining grid stability.

Policy Support and Regulatory Framework: Major government initiatives, including the US Inflation Reduction Act ($369 billion) and EU Green Deal (€1 trillion), have established unprecedented support for energy infrastructure development. Carbon pricing mechanisms now cover 23% of global emissions, creating clear economic signals for investment. This policy framework has catalyzed private investment with a 3.5x leverage ratio on public funds, driving substantial infrastructure development across markets.

Corporate Demand and Market Evolution: Corporate renewable energy procurement has emerged as a powerful market driver, growing 40% year-over-year and reaching 45GW in 2023. Corporate PPAs now support 35% of new renewable installations, creating bankable revenue streams for infrastructure development. This demand, led by major technology companies and industrial users, has become a crucial factor in project development and market growth, particularly in emerging markets.

Energy Security and Grid Resilience Imperatives: Recent geopolitical events and climate challenges have prioritized energy security and grid resilience, driving a 65% increase in storage infrastructure investment and 40% rise in domestic renewable energy deployment since 2022. This has accelerated the development of microgrids and distributed energy resources, with climate-related concerns driving $89 billion in annual resilience investment. The result is a more robust and diversified energy infrastructure landscape.

Utilities Infrastructure

Utilities infrastructure encompasses the systems and networks responsible for the delivery of essential services such as water, waste management, and energy distribution to residential, commercial, and industrial users. These systems form the backbone of modern economies, ensuring the reliable provision of fundamental services that enable societal functionality and economic growth. Utilities infrastructure ensures that communities have consistent access to essential resources, thereby safeguarding public health and supporting the seamless operation of businesses and industries. Unlike energy infrastructure, which focuses on generation, utilities infrastructure emphasizes distribution, storage, and end-user delivery.

Utilities infrastructure plays a pivotal role in enhancing public health, supporting industrial productivity, and fostering sustainable urban development. With global challenges such as climate change, resource scarcity, and urbanization, modern utilities systems must integrate innovative technologies to improve efficiency, resilience, and sustainability. Furthermore, the sector is instrumental in bridging infrastructure gaps in developing regions, where access to reliable utilities remains a critical issue.

Market Overview

The global utilities infrastructure market was valued at approximately $1283.8 billion in 2023 and is projected to grow to $2059.5 billion by 2030, representing a CAGR of 6.99%. This growth is driven by increased urbanization, rising demand for reliable utilities services, and significant investments in modernizing aging infrastructure. The sector's growth trajectory reflects its alignment with global megatrends such as digital transformation, sustainability, and urbanization.

Regionally, Asia-Pacific dominates the market, underpinned by rapid urban expansion and large-scale investments in water and waste infrastructure. North America and Europe lead in terms of technological advancements, including smart utilities systems and circular waste management practices. Meanwhile, emerging economies in Africa and Latin America are focusing on expanding access to basic utilities, highlighting an attractive investment opportunity for new market entrants. These regions also benefit from increasing international funding aimed at improving infrastructure resilience and bridging service gaps.

Growth Drivers

Urbanization and Population Growth: The global population is projected to reach 9.7 billion by 2050, with over 68% expected to live in urban areas. This rapid urbanization drives the need for extensive utilities infrastructure to meet increasing demand for water, energy distribution, and waste management. Emerging megacities in regions like Asia-Pacific and Africa are seeing exponential growth in residential and commercial utilities requirements.

Sustainability Mandates: International agreements like the Paris Accord and national policies aimed at reducing carbon footprints are compelling governments and corporations to adopt green technologies. Investments in renewable energy integration, smart meters, and waste-to-energy (WTE) facilities are increasing to align with these mandates. For example, Europe’s focus on achieving a circular economy by 2050 has accelerated innovation in recycling and water reuse systems.

Technological Innovations: The advent of IoT, AI, and big data analytics is revolutionizing utilities management. For instance, IoT-enabled sensors in water networks can detect leaks in real-time, preventing waste and reducing operational costs. AI-driven analytics enable predictive maintenance for power grids, minimizing outages and improving efficiency. The integration of digital twins is further enhancing planning and optimization of utilities networks.

Resilience and Adaptation to Climate Change: Rising global temperatures and extreme weather events are placing unprecedented stress on utilities infrastructure. Governments and private players are investing in flood-resistant water systems, decentralized wastewater treatment plants, and carbon capture technologies. For example, utilities in regions prone to hurricanes are adopting underground cabling and reinforced grid systems to ensure reliability during natural disasters.

Emerging Infrastructure trends to Watch

With the constant evolution of the sector, there are multiple new trends which are driving growth within infrastructure as priorities shift toward sustainability, resilience, and efficiency. The following are some of the most important and emerging trends gaining attention today, each addressing key challenges in the built environment:

Climate-Resilient Construction: As climate change intensifies, there is surging interest in designing and building structures that can withstand extreme weather events (floods, hurricanes, wildfires, heat waves).

This extends to resilient building design, hardening of critical infrastructure, as well as adaptive urban planning. Driving this trend is the harsh lesson from recent disasters: infrastructure historically has been underprepared for today’s climate realities, leading to costly failures.

Governments and insurers are now pushing for standards that ensure buildings and infrastructure can absorb and recover from shocks. While adding resilience (e.g., elevating buildings, using flood-resistant materials) can raise upfront costs by a few percent, studies show it yields a benefit-cost ratio of about 4:1 – every $1 spent can save $4 in future damages. For example, investing an additional 3% in climate-proofing projects is estimated to generate over $4 in long-term benefits, including avoided repair costs and uninterrupted economic activity.

Startups in this space range from climate risk analytics platforms (to inform infrastructure design) to firms offering resilient construction systems (such as flood barriers or wildfire-resistant building materials). The urgency of climate resilience has made this a prominent topic, with public funding and policy increasingly directed toward adaptation projects.

Smart Buildings and IoT-Enabled Infrastructure: The rise of smart buildings – facilities equipped with IoT sensors, automated controls, and data analytics – is transforming how built assets operate. These technologies enable real-time monitoring and optimization of energy use, ventilation, lighting, security, and occupancy comfort. A building can “sense” conditions (e.g., temperature, air quality, motion) and automatically adjust HVAC or lighting systems for efficiency and safety.

The market for smart building technology is growing robustly, expected to roughly double from about $72 billion in 2021 to over $120 billion by the mid-2020s. This growth is fuelled by the demand for energy efficiency (to cut costs and meet carbon targets) and improved occupant experience. For instance, IoT environmental controls can autoregulate temperatures and ventilation while occupancy sensors turn off lights and AC in empty rooms. In commercial real estate, such systems have demonstrated energy savings of 20-30% or more during pilot projects, directly appealing to building owners’ bottom lines.

Startup activity ranges from AI-driven building management platforms (for example, BrainBox AI’s HVAC optimization, which achieved ~25% energy savings in pilots) to developers of wireless sensors and digital twins that give facility managers granular oversight. Major corporations are also active – Cisco, for example, offers a smart building orchestrator that unifies all building systems on a single IP network for real-time control.

With tens of billions of connected devices projected in the next few years, the IoT-enabled infrastructure subsector will be a cornerstone of future cities, enabling smart buildings and smarter grids and transportation networks that communicate with those buildings.

Construction Robotics and Automation: Long seen as one of the most labour-intensive and dangerous industries, construction is now embracing robotics to boost productivity and address skilled labour shortages.

This subsector includes autonomous or semi-autonomous equipment (drones, robotic excavators, bricklaying robots, rebar-tying robots, etc.) and on-site automation like 3D printers for construction. Robots are being deployed to handle repetitive, heavy, or precise tasks – for example, autonomous bulldozers grading a site, drones surveying progress, or robotic arms laying bricks.

The adoption of robotics is accelerating due to converging pressures: a shortage of skilled construction workers (exacerbated by an aging workforce) and the need to improve safety by offloading dangerous tasks. As a result, the construction robotics market is booming – projected to grow from around $1.4 billion in 2023 to $8 billion by 2033, at ~19% annually.

We have been bullish on this space for a long time and our most recent investment Gravis Robotics, illustrates how robots can transform jobsites. Gravis (which retrofits standard excavators with an “Exosystem” for autonomous excavation) doesn’t just enable automation of excavation, but in fact improves efficiencies by up 30% compared with existing operators. The robotic landscape has rapidly expanded in the past few years with other notable startups including Civ Robotics (robotic layout for outdoor environments) and Luminous Robotics (solar panel installation robots), each piloting their solutions on real projects.

These technologies can dramatically improve speed and consistency – a robot can operate longer hours with exacting precision, which is particularly valuable for large-scale infrastructure like roads or solar farms. While the construction industry has historically been slow to adopt new tech, tangible successes in robotics pilots (and clear ROI in terms of saved labour and injuries avoided) drive broader interest in this subsector.

Sustainable Construction Materials: Given that building construction and materials account for an estimated 11% of annual global carbon emissions (on top of ~28% from building operations), there is an urgent push for more sustainable materials and methods.

This subsector focuses on low-carbon and circular materials – for example, cement and concrete alternatives, recycled or bio-based building products, and timber or composite materials that sequester carbon. Innovations include green concrete that uses supplementary cementitious materials or carbon capture (such as Cemvision which has created a zero-carbon cement by eliminating limestone from Cement), high-performance insulation made from recycled fibers, and mass timber construction that replaces steel or concrete in mid-rise buildings (significantly cutting embodied carbon).

Governments and developers are increasingly mandating lower embodied carbon in projects, spurring this trend. For instance, the World Green Building Council notes that buildings are responsible for 39% of energy-related CO2 emissions globally, so addressing materials is critical to meet decarbonization goals.

Startups in sustainable materials often collaborate with academia and large industry incumbents (cement companies, steelmakers) to commercialize breakthroughs. Beyond reducing carbon, many innovations also aim to improve performance – e.g., new stronger concrete mixes or curing techniques that extend structure lifespan.

As the construction sector faces pressure to “build green,” this subsector is gaining traction, with major projects starting to use green materials (from timber high-rises in Europe to low-carbon concrete in infrastructure projects) and investors pouring money into material science startups. Notably, the Inflation Reduction Act (2022) in the U.S. allocates incentives for low-carbon materials in public projects, and the EU’s Green Deal similarly promotes sustainable product standards, reinforcing this shift.

Grid-Connected Infrastructure and Energy Systems: Infrastructure at the intersection of buildings and the electric grid is another hot area.

This subsector includes distributed energy resources (like solar panels and battery storage on buildings), microgrids for campuses or districts, smart transformers, and electric vehicle chargers – essentially, the hardware and software linking built assets to cleaner, more resilient energy networks.

Several trends drive this: the rise of renewable energy (solar PV on rooftops, wind farms feeding into buildings), the electrification of transportation (requiring extensive EV charging infrastructure in parking lots, garages, and along roads), and the need for grid resilience (backup power and islandable microgrids for critical facilities). For example, large commercial buildings and campuses increasingly install on-site solar + battery systems that can operate independently during outages, ensuring continuity for businesses and communities.

The microgrid market is projected to grow briskly (estimated at ~$37 billion in 2024, reaching $88 billion by 2029) as organizations seek reliable, flexible power solutions. Similarly, EV charging networks are exploding – the global EV charging infrastructure market is expected to surge from about $65 billion in 2023 to over $450 billion by 2030, reflecting the massive rollout of chargers needed to support electric cars and buses.

Startup examples in this space include Span (smart electrical panels that manage home energy flows and integrate with batteries/EVs) and Volta (which built a network of public EV chargers integrated with retail locations, later acquired by Shell). Another aspect is software that orchestrates distributed energy: for instance, virtual power plant platforms allow buildings with solar, batteries, or smart HVAC systems to collectively respond to grid signals (reducing load or feeding power back). These innovations create a more dynamic interplay between individual buildings and broader energy infrastructure. For venture investors, this subsector is attractive for its growth because it often involves recurring revenue models (software subscriptions, energy services) layered on top of hardware deployments.

Water Reuse and Recycling Systems: With water scarcity a growing concern in many regions, technologies for water reuse in buildings and developments are gaining prominence.

This subsector covers on-site greywater recycling (capturing sink and shower water for reuse in toilet flushing or irrigation), rainwater harvesting systems integrated into buildings, advanced wastewater treatment for commercial properties, and smart water grids that detect leaks and optimize usage.

Globally, the water reuse market is expanding at ~10–14% CAGR and could reach $30–50 billion in the next decade. Drivers include chronic droughts, rising water costs, and sustainability goals prompting developers to reduce consumption of fresh potable water. Emerging building codes in places like California and parts of Europe are beginning to encourage or mandate water recycling in new large developments.

Startups like Epic Cleantec – which provides turnkey greywater recycling systems for high-rise buildings – are seeing momentum. In 2024, Epic Cleantec raised a $12 million Series B round to expand its on-site water reuse solutions for commercial real estate. Other examples are Waterhub systems on university campuses that treat wastewater for campus cooling and landscaping or smart irrigation controllers that integrate weather data to minimize water waste in urban landscaping.

These systems often require significant collaboration with local regulators (for health standards) and utilities, but their adoption is accelerating where water stress makes a compelling business case. In addition to technology for recycling water, infrastructure projects for stormwater capture and flood control in cities (like bio-swales and permeable pavements) also tie into this subsector, making urban water infrastructure more sustainable and resilient.

Urban Mobility Integration: Transportation infrastructure is evolving in tandem with urban development, creating a subsector focused on mobility solutions tied to the built environment.

This spans transit-oriented development (integrating real estate projects with public transit stations and pedestrian/bike infrastructure), EV charging and electric mobility services embedded in buildings, and micro-mobility hubs for bikes and scooters in urban centers. With cities striving to reduce car dependence and emissions, new real estate projects often feature mobility amenities: for example, office campuses providing electric shuttle buses, apartment complexes with dedicated e-scooter parking/charging, or shopping centers integrating ride-share drop-off zones and EV fast chargers.

Globally, urban mobility is undergoing a transformation – the proliferation of electric vehicles and the push for “15-minute cities” (where daily needs are within a short walk/bike ride) mean infrastructure must support new modes. Public policy is catalyzing this: the U.S. Infrastructure Investment and Jobs Act (IIJA) earmarked $7.5 billion to build out EV charging stations nationwide, and the EU’s Fit for 55 package similarly targets a vast expansion of charging infrastructure, signalling that electric mobility will be a core component of future infrastructure. We are already seeing the impact: the International Energy Agency notes that the global number of public EV chargers grew to ~4 million in 2023 and is on pace to exceed 15 million by 2030 under current trends.

Startups and mobility tech firms are seizing these opportunities. For instance, ChargePoint and Ionity (in Europe) deploy charging networks at scale, while others like UrbanFootprint help city planners analyze how to place mobility infrastructure for maximum impact. There’s also convergence with building management: smart parking systems, traffic sensors in smart cities, and real-time transit data integrated into commercial building apps all improve how people move in and around built spaces.

This subsector is unique in that it blends physical infrastructure (stations, vehicles) with digital platforms (mobility-as-a-service apps, scheduling software), and success often involves partnerships between private tech providers and public city authorities. It’s an emerging area, but one fundamental to making urban growth sustainable and convenient.

Beyond the above, other notable emerging areas include off-site and modular construction (factory-built modules to improve construction productivity), digital twins of infrastructure (creating virtual models for better asset management), and circular economy in construction (platforms to enable reuse of materials). Each of these intersects with the subsectors identified, collectively driving infrastructure modernization.

Why Infrastructure Matters Now: Global Drivers

Infrastructure has always been critical to economic and social development, but its importance has become even more pronounced today due to several global macroeconomic and strategic drivers:

Population Growth and Urbanization: Over 55% of the global population now lives in cities—a figure set to reach 68% by 2050, with growth concentrated in Asia and Africa. This trend is straining existing infrastructure and driving urgent demand for housing, transport, water, and energy. The number of megacities is expected to rise from 33 to 43 by 2030. Without major investment, cities face worsening slums, congestion, and service gaps. India, China, and Nigeria alone will account for 35% of urban growth, requiring massive infrastructure expansion. This is both a challenge and a historic opportunity. The global infrastructure market, worth ~$10 trillion in 2023, is projected to exceed $15 trillion by 2030.

Economic Growth and the Infrastructure Investment Gap: Infrastructure drives economic growth by enabling commerce, mobility, and productivity. Yet global investment is falling short. The G20-backed Global Infrastructure Hub estimates $94 trillion is needed by 2040, but up to $18 trillion may go unfunded at current rates. This gap affects both aging infrastructure in developed economies and essential new builds in developing ones. In the U.S., even with recent funding, the ASCE projects a multi-trillion-dollar shortfall over the next decade. Globally, annual infrastructure spending must rise from ~3% to 3.5–3.7% of GDP. Governments are responding with historic packages: the $1.2 trillion U.S. Infrastructure Investment & Jobs Act allocates $550B in new spending, while the EU’s recovery and green initiatives target sustainable infrastructure across member states. Still, public funds alone are insufficient, Private capital and innovation are essential to meet demand and improve infrastructure delivery at scale.

Decarbonization and Climate Targets: Infrastructure is both a major emissions source and a critical enabler of the low-carbon transition. Most large economies have committed to net-zero by 2050, driving demand for clean energy, building retrofits, EV infrastructure, and emerging systems like hydrogen and carbon capture. The European Green Deal’s “Fit for 55” targets 55% emissions cut by 2030, including mandates to renovate 35 million buildings. Programs like the EU Renovation Wave and New York City’s Local Law 97 are pushing large-scale infrastructure upgrades. Adaptation is equally urgent. Infrastructure must become climate-resilient to withstand rising physical risks. One estimate suggests meeting global net-zero goals will require $3.5 trillion in additional investment by 2030 for clean energy and water access alone. Governments are embedding climate into infrastructure policy: the EU taxonomy directs capital to green projects, and the U.S. Inflation Reduction Act channels billions into renewable energy, EVs, and low-carbon materials. Infrastructure has become the linchpin of climate action—driving both mitigation and resilience—and is attracting historic levels of innovation and funding.

Public Policy and Stimulus: In the post-COVID era, governments launched infrastructure-focused stimulus to drive recovery and innovation. The U.S. IIJA and IRA provide over $1 trillion for sectors ranging from roads and rail to EV infrastructure and grid modernization. The CHIPS Act expands domestic semiconductor production, reflecting a broader industrial policy trend. In Europe, funding through the Green Deal and Connecting Europe Facility supports cross-border and digital infrastructure. These initiatives increase available capital and prioritize sustainability and resilience—opening the door for technology providers and startups through public procurement and pilot deployments.

Supply Chain Resiliency and Geopolitics: Recent shocks—from the pandemic to the Ukraine war—exposed vulnerabilities in infrastructure supply chains. Material shortages and price spikes (e.g., steel doubling in 2021) delayed projects and highlighted the need for more resilient systems. Governments are now pursuing domestic manufacturing of critical inputs (e.g., EV batteries, transformers), reshoring supply chains, and investing in digital tools for risk management. National security concerns further elevate infrastructure self-sufficiency, while technologies for asset monitoring and smart grids enhance operational resilience. Startups are innovating with tools for procurement, inventory, and alternative materials to mitigate future disruptions.

Post-Pandemic Priorities and Quality of Life: COVID-19 redefined infrastructure priorities—highlighting gaps in public health, broadband access, and indoor air quality. It accelerated demand for healthier buildings, flexible transit, and outdoor spaces. Cities are embracing “15-minute” design concepts with localized infrastructure and mixed-use neighbourhoods. Remote work has prompted a rethink of downtown areas and catalysed investment in digital infrastructure—now viewed as a “fourth utility.” With data infrastructure growing at >11% CAGR through 2030, and bipartisan support for broadband expansion, the link between infrastructure, resilience, and quality of life has never been clearer.

In summary, infrastructure has vaulted to the top of global agendas because it is seen as the key to addressing current challenges (economic recovery, job creation, supply chain security) and future imperatives (climate action, urban population needs). As a result, trillions in capital – both public and private – are earmarked for infrastructure worldwide, creating a ripe environment for innovation and new entrants offering better, faster, and greener ways to build.

Unique Challenges for Technology in Infrastructure

While the need for innovation in infrastructure is clear, deploying new technology in this sector comes with unique challenges. Infrastructure (especially in construction and civil engineering) has historically been slower to digitize and adopt new tech than finance or manufacturing industries. Key factors that make infrastructure distinct from a tech adoption standpoint include:

High Regulation and Safety Requirements: Infrastructure and construction are heavily regulated for safety, environmental impact, and public interest.

Buildings must adhere to strict codes; bridges and utilities face rigorous standards and inspections. This means any new technology (be it a construction robot, a novel material, or AI software controlling critical systems) must clear high regulatory hurdles and prove it doesn’t compromise safety or compliance.

The approval cycles can be long – for example, getting a new building material approved in model codes or by local permitting authorities can take years. Risk aversion is prevalent: an experimental tech failure in infrastructure isn’t just a financial loss; it could be catastrophic (e.g., a structural collapse). Thus, incumbents often prefer proven solutions and incremental improvements.

Even when a technology is demonstrably safe, the perception of risk can slow adoption; many project owners stick with “what worked last time” to avoid regulatory or liability issues. This conservative approach is a fundamental brake on the rapid turnover of innovation seen in, say, consumer electronics. Navigating this environment often requires tech developers to engage early with regulators and sometimes to help shape standards.

Long Asset Lifecycles: Infrastructure assets are built for decades of service. A bridge or power plant might have a 50+ year lifespan, and buildings often last 30-100 years.

This long horizon affects technology adoption in two ways. First, decisions made at construction (e.g., what systems to install) lock-in technology for a generation. If you install a certain sensor network or management system in a smart building, it may not be easily replaceable for many years. Investors in infrastructure, therefore, require future-proofing and proven durability. They are cautious about adopting tech that might become obsolete or unsupported. Second, the procurement and planning cycles for new infrastructure are themselves long.

Large projects have planning phases spanning years, so introducing a new technology mid-cycle is difficult; one must catch the wave in the early design stage or potentially wait a long time for the next project. The long lifecycle also means that the benefits of technology (like lifecycle cost savings or carbon reduction) must be evaluated over many years, which can be complex. It’s often easier to stick to conventional methods with known maintenance profiles. However, this is gradually changing as more modular and upgradable approaches emerge (for instance, some smart infrastructure systems are designed to be retrofittable, and digital layers can be updated even if the physical structure stays the same).

Still, the mindset in infrastructure remains: reliability over novelty. Contrast this with software where fast iterative updates are expected – in infrastructure, one can’t “move fast and break things” because the things are bridges or buildings full of people.

Procurement Complexity and Fragmentation: How infrastructure projects are procured and delivered can impede tech adoption.

Projects often involve multiple stakeholders – owners, architects, engineering firms, general contractors, subcontractors, financiers, and government agencies – each with their own priorities and contracts. This fragmentation makes it hard to introduce innovation that cuts across the project. For example, using a sophisticated project management AI might help the general contractor. However, if the contract is a fixed bid, the financial incentive to try it may be low (any efficiency gained doesn’t necessarily improve their bottom line, depending on the contract structure).

To add to this, public procurement rules in many places favour lowest-bid contractors and well-established methods, not leaving room to “pay extra” for innovative approaches that might save money in the long run. The result is a kind of chicken-and-egg: no one wants to bear the upfront cost or integration hassle of new tech unless the other parties are on board and the contract rewards it.

The large size of many infrastructure projects also means sales cycles for new technology are long – a startup might spend 12-18 months in negotiations and trials before getting incorporated into a single big project’s specs. This is challenging for young companies and deters some investors. Furthermore, construction is notorious for adversarial contract relationships and thin margins for contractors (~5% or less in many cases), which makes those players less inclined to experiment for fear of cost overruns.

In short, the industry structure has inertia that pure technical merit can’t easily overcome without aligning incentives. Some changes, like progressive design-build contracts or public-private partnerships, are trying to allow more innovation by emphasizing value over the lowest cost, but these are not yet universal.

Operational Risk and Criticality: Many infrastructure systems are mission-critical – they must run 24/7 with minimal downtime (power grids, water treatment plants, transportation networks). Introducing untested technology into these operations carries significant risk.

For instance, utility companies have been cautious to integrate IoT and AI into grid control because a software glitch could cause a blackout. Cybersecurity is also a major concern now that infrastructure is becoming connected; a breach in a “smart” system could have physical consequences (as seen in some high-profile hacks of pipeline and water infrastructure).

This risk sensitivity means that new tech often undergoes lengthy pilot phases and incremental integration. Adoption tends to happen in waves of proven reliability: first a pilot in non-critical application, then a small deployment in parallel to legacy system, and eventually wider rollout once trust is earned.

Additionally, the operational handoff in infrastructure is unique – the team that builds or installs a system (often contractors) is not the one that operates it long-term (often the owner or facility manager). If a technology complicates operations or maintenance, the operators might resist it even if the builders liked it (e.g. a building owner might be wary of a super high-tech HVAC if their maintenance staff isn’t trained on it). This split incentive can hamper innovations that require continuity from the build-to-operate phase.

It’s worth noting that some areas of infrastructure operations have seen faster tech uptake when the value is clear and risk manageable. For instance, drones for routine infrastructure inspections (of bridges, power lines, rooftops) have been adopted relatively quickly because they improve safety for workers and don’t interfere with the asset’s functioning. Overall, though, the “critical infrastructure” mindset is one of prudence – technology must prove itself at a small scale and over time before it will be entrusted with full operational control.

Cultural and Workforce Factors: The construction and infrastructure sectors have a deeply rooted culture built on experience and manual problem-solving.

Many firms are family-run or have done business in a certain way for decades. There can be organizational resistance to change (“we’ve always done it this way”) and a lack of digital skills in the existing workforce.

According to surveys, even in recent years, a substantial share of contractors still relies on manual, paper-based processes – over a quarter of contractors in one study were using pen-and-paper for project management tasks.

This second-to-last digitization rank (with only agriculture behind) was highlighted by McKinsey’s Industry Digitization Index. Indeed, construction is the world’s second least digitized sector. This means tech providers must often start by convincing users of the basic value of digital tools and then train them rather than plugging them into a receptive environment. The aging workforce is also a factor; many seasoned field managers are less comfortable with new software or gadgets, and there is a generation gap before digital-native younger professionals move into decision-making roles.

Additionally, political cycles in public infrastructure can influence tech adoption – a new mayor or agency head might champion a smart city project only to lose momentum under a successor. All these human factors add friction.

While infrastructure tech adoption faces barriers—regulation, long lifecycles, and fragmented procurement—momentum is clearly building. Some tools have crossed the threshold into mainstream use. BIM is now standard on large projects, replacing 2D drawings with 3D digital models. Drones and reality capture, once novel, are now common due to ease of use and clear ROI. Labor shortages and cost pressures are accelerating adoption, alongside lessons from COVID-19, which catalyzed cloud-based collaboration and remote site monitoring. Venture capital surged into construction tech in the late 2010s; despite a dip in 2022, investor confidence remains strong as impact becomes visible. Not adopting tech is now seen as a risk—potentially harming competitiveness, climate performance, and talent attraction. Adoption is gaining traction in project management software, modular and prefab construction, digital twins for asset operations, and low-carbon solutions like electric equipment and efficient building systems. These advances suggest an inflection point: infrastructure may soon follow the digital transformation path that manufacturing took decades ago—once key obstacles are addressed, broader acceleration is likely.

Emerging Technologies Transforming Infrastructure

Despite the challenges, a wave of emerging technologies is being progressively adopted across the built environment. These technologies promise to enhance productivity, sustainability, and transparency in infrastructure projects, and many have matured to a point where pilot deployments are turning into full-scale rollouts. Below is an in-depth overview of key technology domains reshaping infrastructure, along with startup examples and funding insights illustrating their traction:

Artificial Intelligence and Data Analytics

AI is transforming how infrastructure is planned, built, and operated. In construction, AI-driven platforms like Conxai create a virtual command center to control different aspects of the jobsite. In progress tracking, startups such as Buildots, OpenSpace, Track3D, and AI Clearing use computer vision to match as-built conditions to digital plans, catching errors early and reducing delays.

In design, AI tools like those from Transcend and Spacemaker (acquired by Autodesk for $240M) help architects quickly model urban layouts based on constraints like sun exposure or zoning. Meanwhile, infrastructure operators use AI for predictive maintenance—anticipating equipment failure before it occurs—and smart city programs apply AI to optimize traffic, energy, and waste systems.

Collectively, AI-driven construction startups have raised over $1B, as AI proves its ability to lift productivity, reduce overruns, and bring real-time insight into complex projects. As interfaces become more user-friendly, AI adoption is poised to follow a BIM-like trajectory—growing from early use to standard practice.

Robotics and Autonomous Equipment

Robotics are automating repetitive and hazardous tasks in construction. Gravis Robotics retrofits excavators with autonomy kits for earthworks, enabling not just autonomy but also superior performance to experienced operators. Robots like Tybot and Ironbot automate rebar tying, while Civrobotics and Dusty Robotics perform exterior and interior site layout tasks with precision and consistency. Raise Robotics is a multi-use robot that automates the façade installation process.

Drones, now widely adopted, accelerate surveying and inspection. Skydio’s autonomous drones inspect bridges and towers, while Nrobotics robot captures 3D scans on active sites. These systems improve safety, reduce time on site, and free up skilled labor.

Adoption is moving beyond pilots—modular robot tools are becoming SOP on certain job types, especially where labor is scarce or repetitive work dominates. Robotics startups are now seeing substantial funding and strategic interest, with investors shifting from “moonshot” skepticism to backing validated, jobsite-ready products.

Internet of Things (IoT) and Sensor Networks

IoT is the sensory layer of smart infrastructure. In buildings, connected devices (e.g., thermostats, CO₂ sensors, motion detectors) inform automated energy management and predictive maintenance. Platforms from Verdigris, Enertiv, and incumbents like Johnson Controls optimize HVAC, lighting, and equipment uptime.

In civil infrastructure, IoT-enabled grids and water systems monitor flows, detect outages, and improve efficiency. Structural health monitoring uses embedded sensors in bridges, tunnels, and dams to detect stress or movement, enabling preventive action. Companies like Senceive provide wireless monitoring systems widely used in tunneling and rail.

IoT also tracks assets—telematics on machinery, RFID on materials, and wearables for worker safety. Together with analytics, this data turns into actionable dashboards (e.g., “HVAC in Zone 3 exceeding baseline energy use”). Challenges like interoperability remain, but maturing standards and plug-and-play devices are driving broad uptake, supported by measurable ROI—often 15–25% in energy savings alone.

Sustainable Materials and Circular Economy Platforms

Sustainability mandates are driving innovation in materials and reuse. Startups like Concrete4Change, CarbonCure, CarbonBuilt, and Solidia are commercializing low-carbon concrete using CO₂ injection or carbonated curing while those like Cemvision and Sublime are trying to create zero carbon cement. Mass timber is gaining traction as a renewable alternative to concrete and steel, while high-recycled-content steel from electric arc furnaces reduces emissions.

Digital platforms are enabling circularity. Soil Connect matches fill material between jobsites; Wastebox coordinates waste removal and recycling. “Deconstruction” startups focus on salvaging reusable building components, while platforms like Madaster create “material passports” for buildings to track content and facilitate reuse.

With global construction waste topping 2B tons annually and <40% currently recycled, there’s a multi-hundred-billion-dollar opportunity in circular construction. Public policies like Buy Clean (US/UK) and mandated recycled content quotas are further boosting demand.

Off-Site and Modular Construction

Off-site methods—ranging from full volumetric modules to prefab panels—are reshaping project delivery. Factory_OS produces modular apartments in California, saving up to 40% in build time. VBC (which acquired Katerra’s assets) and Blueprint Robotics focus on hotels, housing, and walls-as-kits for rapid assembly.

ICON, which raised $207M, uses 3D printing to build homes and community structures layer by layer with concrete mixes. Modular approaches reduce timelines, material waste, and labor dependency—particularly valuable in housing, healthcare, and datacenter builds.

Though Katerra’s failure cooled investor enthusiasm, modular construction is rebounding with tighter developer integration and niche specialization. Government interest in modular barracks and hospitals further signals long-term momentum.

Digital Twins and Asset Management Software

Digital twins—virtual models fed by real-time sensor data—are emerging as key tools for infrastructure owners. Airports, office buildings, and utilities are using twins to monitor systems, simulate scenarios, and reduce energy costs. Willow, which built a twin of the World Trade Center, and Cityzenith are leading players in the space.

AI-enhanced asset management tools are helping cities and utilities plan repairs and prevent failures. For example, AI can prioritize which water mains to replace based on leak history, age, and material. Innovyze and StreetLight Data (now part of Autodesk and Jacobs, respectively) are enabling smarter water and transport planning.

Digital twins not only cut operational costs but also help bridge the knowledge gap as experienced engineers retire. Many governments now require digital handovers (BIM + asset data) for major projects, signaling that digital twins may soon become standard infrastructure deliverables.

From AI and robotics to sustainable materials and digital twins, infrastructure tech is no longer hypothetical—it’s actively reshaping how assets are designed, delivered, and maintained. These solutions address labour shortages, climate mandates, cost pressures, and the need for resilience. While challenges remain, the convergence of proven use cases, policy support, and investment capital is pushing the sector toward a long-overdue digital and industrial transformation.

Corporate-Startup Engagement and the Pace of Adoption

Corporate-startup engagement models have become increasingly important to accelerate technology adoption in this traditionally slow-moving sector. Many large infrastructure companies – construction contractors, engineering firms, materials suppliers, and utilities – recognize that partnering with startups can give them an innovative edge without having to invent everything internally. The prevailing engagement models include pilots, corporate venture capital (CVC) investments, and joint innovation platforms or accelerators:

Pilot Projects and Venture Clienting: Pilots remain the primary entry point for startups into infrastructure. A city agency or contractor may trial a startup’s solution on a limited project scope—e.g., AI traffic optimization at select intersections or robotics for trenching on one jobsite. These are often structured as paid engagements, following a "venture client" model that allows corporates to test innovation with minimal risk while giving startups critical validation. Successful pilots frequently lead to broader rollouts, as seen with PlanGrid, which scaled rapidly after early wins and was later acquired by Autodesk for $875M. Many large firms now have dedicated innovation teams and budgets for pilots. For example, Ferrovial piloted a drone inspection solution across multiple assets, then expanded deployment and became an investor. A single corporate pilot can unlock dozens of internal projects, making strategic alignment and internal champions critical for startups.

Corporate Venture Capital (CVC): Many infrastructure incumbents have launched dedicated CVC arms to invest in strategically aligned startups. Notable examples include Cemex Ventures, Hilti Ventures, Saint-Gobain NOVA, ENGIE New Ventures, and Honeywell Ventures. These investors offer more than capital —they bring deep industry expertise, access to channels, and credibility. Funds like Construction Venture by Bouygues Construction (€50M) reflect a growing appetite to back technologies that can be integrated into core operations. Similarly, consortium-backed funds—like Zacua Ventures, with LPs including Procore, Volvo, and Cemex—bridge startups with a wide corporate network, facilitating both piloting and scaling. CVCs are increasingly active in mid-to-late-stage rounds. For instance, when Dusty Robotics raised capital, its backers included both financial investors and general contractors. Strategic acquisitions are also increasing—Oracle’s purchase of Aconex and Autodesk’s acquisitions in IoT and scanning reflect growing M&A interest, providing exit pathways and signaling market maturity.

Joint Innovation Platforms and Accelerators: Corporates and public agencies are establishing structured programs to co-develop and test technology. VINCI’s Leonard hub runs accelerator programs connecting startups with VINCI units for piloting future-of-cities solutions. Skanska scouts startups to trial on live sites. Public agencies like Transport for London (TfL) run challenges inviting startups to solve real operational issues, granting data access and pilot slots. Smart city consortiums create testbeds for multi-stakeholder pilots, enabling integration of various technologies in real urban settings. The annual Construction Startup Competition—hosted by Cemex Ventures, Ferrovial, Hilti, and others—attracts global startups for mentoring, piloting, and investment opportunities. Academia-industry partnerships are also gaining traction, with university spinouts in construction robotics often supported by industry sponsors. These joint innovation models give startups domain access and feedback, while corporates get customized, early-stage tech.

These engagement models have significantly improved the pace of tech adoption in infrastructure in recent years. Whereas a decade ago, a startup would struggle even to meet with a big contractor, now the same contractor might be actively scouting for a startup to solve a specific problem and even funding that startup’s development. Corporate validation also reassures conservative clients – if a global firm like Bouygues or a major utility backs a startup, others feel safer adopting it. Moreover, the influx of corporate participation is a sign that the cultural shift we mentioned as a barrier is slowly happening: the leadership of these firms is openly talking about digitization and innovation, creating internal mandates to try new approaches rather than avoid them.

Current vs. Forward-Looking Pace of Adoption

Technology adoption in the built environment is accelerating, though unevenly. Tools like BIM, digital project management, and drones are now standard on large projects. AI-driven scheduling and predictive tools are gaining traction among top contractors, and new equipment increasingly arrives smart and semi-autonomous. Yet many smaller firms and public agencies remain behind, especially in developing markets.

Over the next decade, baseline adoption is set to rise sharply — driven by a digitally native workforce, mounting pressure for efficiency and sustainability, and a strong pipeline of affordable, ROI-proven solutions. Corporate-startup collaboration is deepening, with more co-development initiatives and customized tech for infrastructure use cases.

Investor confidence remains high: construction tech funding grew in 2024 despite broader market headwinds, and most early-stage investors plan to maintain or increase allocations in 2025. The shift from pilot to scale is underway.

For investors like us, this is a rare opportunity to back the foundational technologies shaping the next era of infrastructure, making construction faster and safer, buildings greener and smarter, and networks more resilient. The sector is moving from laggard to leader, with innovation poised to redefine our cities, our climate goals, and quality of life on a global scale.